Small businesses forced to cut staff, reduce opening hours as cost of living stops spending

“If it goes on like this for another six or seven months like this, we’re going to close.”

That’s the reality for Ashraf Saleh’s restaurant Coya in Sydney’s North Shore as the small business battles the dramatic reduction in consumer spending while cost of living pressures bite.

Saleh opened the restaurant in Northern Beaches eight years ago and business was booming but in the last few years with COVID-19 and now the cost of living crisis, he’s struggling to keep the doors open.

Is your small business struggling with cost pressures? Contact the reporter at smeacham@nine.com.au

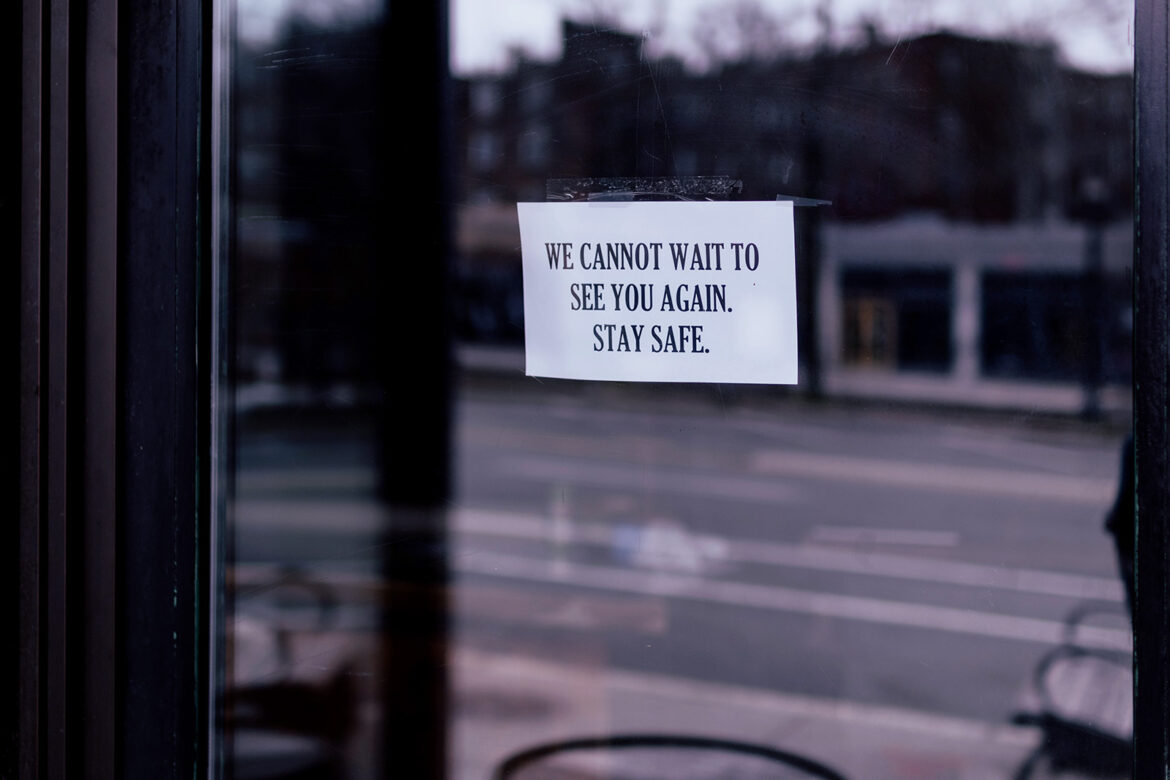

Through COVID-19 when many businesses closed as spending stopped and people were locked down at home, Saleh said the restaurant survived due to government support like JobKeeper.

The restaurant moved to St Leonards in 2022 and Saleh said it was a “full house” until February this year when cost of living pressures, interest rates and inflation peaked.

“One day interest rates rose and cost of living went up, now we’re losing customers every night,” he told 9news.com.au.

“The bills never stop. We’re really struggling.”

He said the restaurant had to say goodbye to its casual staff due to the cost pressures, going from five waiters to just two.

“Even with two staff we don’t have the money to pay their wages,” he said.

“There’s just not enough business to pay them as people have no money to spend.”

Saleh has also changed the opening hours of the business from six days a week to just four days from Wednesday to Saturday.

As interest rates rise to 4.1 per cent in July from just 0.1 per cent in May 2022, Saleh said the rent pressures for his business to stay where it is are growing.

“I’m always talking to the landlord and paying the bills two or three weeks late,” he said.

“Thankfully our landlord is understandable.”

All costs have increased for Saleh including suppliers and groceries for the restaurant as inflation hits the price of fruit, vegetables and other foods.

“High-end products I can’t buy anymore. We stopped buying a lot of things. We’re just buying what we need,” he said.

“I would rather I wouldn’t get paid, so my suppliers get paid, my staff get paid and my rent gets paid.”

Then there are the unexpected costs like dishwashers breaking down, the toilets breaking down – Saleh said there is no money to cover these expenses.

“We can’t even refinance and borrow money to fix things,” he said.

It comes as Aussies begin to slow their discretionary or non-essential spending as expenses start building like mortgage repayments, the price of groceries and electricity and gas bills.

The latest Australian Bureau of Statistics (ABS) data showed Aussies spent 0.6 per cent less compared to May last year on discretionary goods – like eating out at restaurants.

“This comes as households respond to cost-of-living pressures,” ABS head of business indicators Robert Ewing said.

The pressures like letting staff go, changing opening hours and struggling to afford rent are being felt across the small business sector.

The Australian Retail Association and American Express research found while 34 per cent of the 600 small businesses surveyed for the data feel confident about the financial year ahead, an equal amount feel very concerned.

One-third of the small businesses said their costs have increased more than 10 per cent – well above the rate of inflation.

The research found 12 per cent of businesses have reduced staff and 6 per cent have changed store hours.

“Inflation and cost of living increases have created a retail spending slowdown that is likely to continue into the new financial year,” ARA CEO Paul Zahra said.

“This is a unique period in our economic history… it is very hard to make predictions.”

Zahra added this financial year will see leasing costs surge, inflation hit suppliers and the debts from the COVID-19 period called in.

The research found small businesses want governments to include tax breaks, utility reductions, lease cost reductions, wage cost reductions and reduced inflation.

Saleh echoed this calling for the government to implement concrete measures “instead of just talking”.

He’s worried without government intervention, he and other businesses won’t survive through this financial year.