When will the cost of living decrease? The perfect storm hitting our hip pockets

But it seems the only certainty these days is uncertainty.

Devastating floods, horrific fires, the war in Ukraine and the lingering pandemic are taking a toll on our hip pockets, driving up the cost of everything from petrol to the humble lettuce.

So when is it going to stop?

Unfortunately, according to economist Professor Justin Wolfers, probably not any time soon.

“I’ve never seen so much economic change in as short of a period in my entire lifetime,” he told 60 Minutes.

“Not surprisingly, it’s going to have ripple effects for quite some time to come.”

At the moment, the most noticeable effect has been a rising sense of panic, especially since this perfect storm is completely out of our control.

“The [Reserve Bank of Australia] can’t destroy Putin, can’t fix supply chains, can’t get rid of the virus in China,” Justin said.

“But what it can do is it can affect inflation.”

The RBA has been trying to do just that by aggressively increasing interest rates but that’s only worsened the strain on families who cashed in on previous record lows.

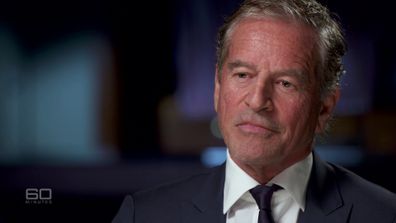

In an interview with 60 Minutes, finance expert Mark Bouris admitted he had never seen such uncertain times but said there were ways to ease the pain.

“Now it’s about building strategies and not panicking,” he said.

“The strategies have to be about saving money and everything you do to make sure that you can continue to pay your mortgage.”

And that’s what the Reserve Bank is hoping for, Australians tightening the purse strings to ultimately bring down prices and, in turn, inflation.

Unfortunately, that will be a slow process.

“The general consensus is that we will see mortgage pain for the next two years,” Bouris told reporter Tara Brown.

“Borrowers who are probably already stretched, particularly those who are borrowing in the last two or three years, they are going to bear the brunt of this.”

Although he warned there were still plenty of tough times to come, Bouris didn’t believe the property market would become a “bloodbath”.

“We are definitely going to see an uptick in people having to sell their property,” he said.

“But I don’t expect it to be a great number because we’ve been through these processes before over the last 30, 40 years.”

And while the gloomy outlook had many fearing a recession is imminent, Wolfers was more optimistic.

“A recession is when the economy shrinks, there are fewer jobs, less spending, less production,” he explained.

“None of those are our fear right now.”

His message to Australians, as simple as it sounds, is to batten down the hatches and hold tight.

“The current inflationary moment is scary and it hurts many families’ bottom lines, but it will pass,” he said.