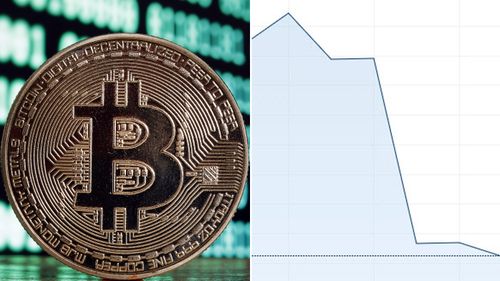

Bitcoin value tumbles almost 50 per cent since record November

Bitcoin has lost almost half its value since its November high, with cryptocurrency prices continuing to plunge as major economies look to curb their growing popularity.

And it’s not just Bitcoin, as cryptocurrencies in general have had a dismal start to the year. Bitcoin has fallen over 8 per cent in the last 24 hours, and at the time of publishing was worth $USD 35,348 ($49,205).

The world’s most valuable cryptocurrency has plummeted over 20 per cent since the beginning of the year.

In November it was trading at a record high of $USD 68,990 ($96,036).

Its peers have fared worse.

Ethereum, the world’s second most valuable cryptocurency, has fallen more than 12 per cent in the last 24 hour, and was trading at around $USD 2,400 ($3,340) as of mid-morning Saturday, according to CoinDesk.

That’s an almost 30 per cent drop since the start of the new year.

Investors are getting jittery about digital currencies and other riskier assets ever since the US Federal Reserve signalled it may unwind economic stimulus more aggressively than expected.

Governments are cracking down as well. On Thursday, Reuters reported that Russia’s central bank has proposed a ban on crypto use and mining.

Russia is one of the biggest crypto-mining nations in the world, but its central bank said that digital currencies can pose a threat to the country’s financial stability.

The Russian proposal comes just a few months after China launched a full-scale clampdown on cryptocurrency, banning both trading and mining.

Other countries are also flirting with a ban on crypto. In November, India said it was preparing to introduce a bill that would regulate digital currencies, although much is still unknown about that proposal.

Earlier this week, India’s prime minister Narendra Modi said that global cooperation is needed to tackle problems posed by crytocurrencies.

However, not everyone is pessimistic. Goldman Sachs said that the price of bitcoin could reach more than $USD 100,000 ($$139,000) within the next five years.

In a report published earlier this month, the bank’s analysts said they saw strong gains ahead because bitcoin would increasingly steal market share from gold.